Introduction

Economic crimes in Estonia encompass a wide range of activities that harm the economic interests of society and individuals. Under Estonian criminal law, such crimes include fraud, tax evasion, money laundering, and various fraudulent activities aimed at illegal enrichment. The law holds both individuals and legal entities accountable, applying administrative measures and criminal penalties, including imprisonment. Here’s an overview of key aspects to understand, along with answers to frequently asked questions.

20 Questions for a Lawyer

- What is considered an economic crime in Estonia?

Economic crimes are actions that violate rules of economic activity, harm the state budget, involve fraud, or tax evasion. - What are the penalties for economic crimes?

Penalties vary depending on the severity of the offense, ranging from fines to up to 20 years of imprisonment. - What types of fraud are classified as economic crimes?

Types include bank fraud, credit fraud, and deceptive acts related to assets or income. - What is tax evasion, and how is it punished?

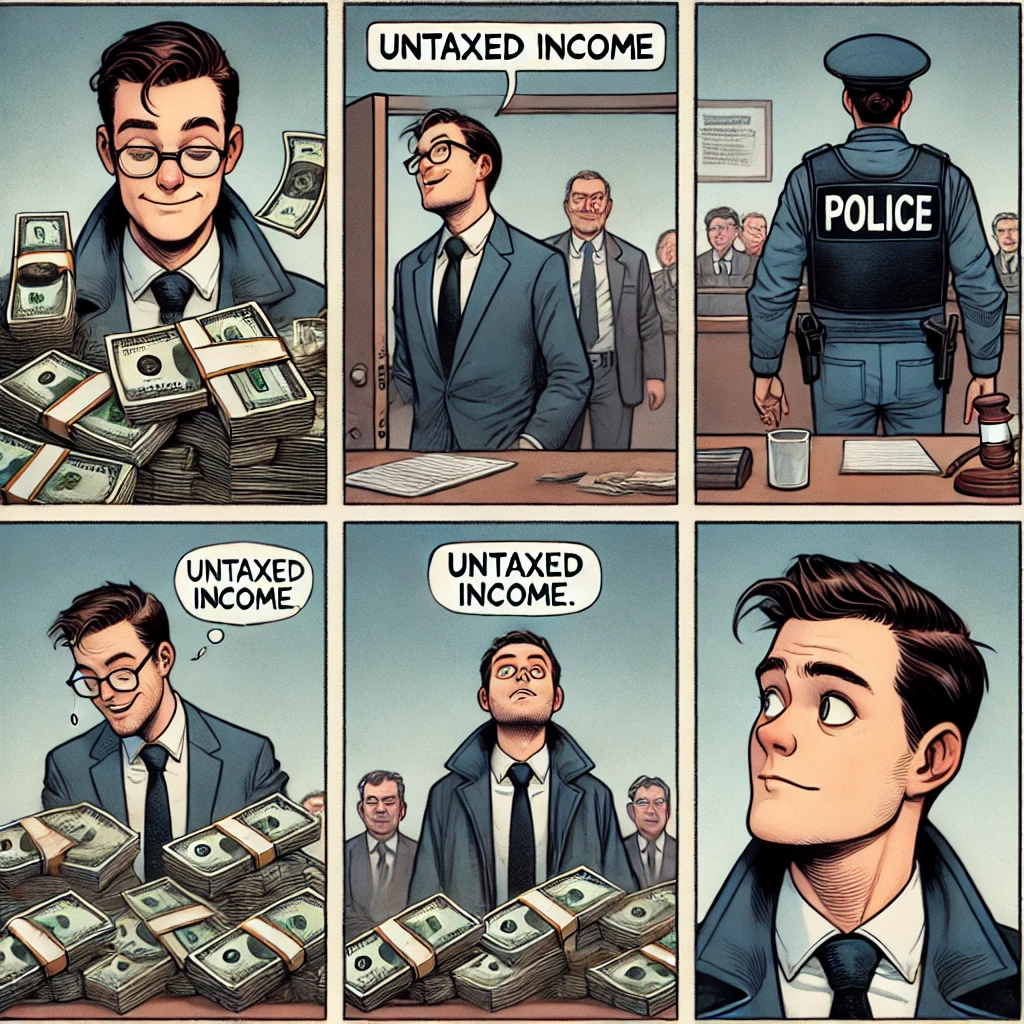

Tax evasion involves concealing income or expenses to reduce taxable income. It can result in significant fines or, in some cases, imprisonment. - What does money laundering mean?

It is the process of concealing illegally obtained funds through complex transactions to make the funds appear legitimate. - What measures does the state take against money laundering?

The law requires financial institutions to verify client identities, investigate sources of income, and report suspicious transactions. - What are the unique aspects of economic crimes by legal entities?

Legal entities are responsible for the actions of their employees and management, which means a company itself can be held accountable. - What liability do banks have in money laundering cases?

Banks are obligated to follow procedures to prevent money laundering. Violations can lead to fines or even closure. - Can economic crimes be prosecuted abroad?

Yes, if the crime affects Estonian interests or is committed against Estonian citizens abroad. - How is fraud defined by law?

Fraud is defined as intentional deception for gain and is punishable by law. - What evidence is required for economic crimes?

Evidence may include documents, electronic correspondence, and witness testimonies. - Who investigates economic crimes?

These crimes are investigated by the police, prosecutor’s office, and sometimes the tax authorities. - Can one be held liable for attempted fraud?

Yes, attempts at fraud are also punishable. - What is bribery, and how is it penalized?

Bribery is the offering of money or benefits to an official for a favorable decision. It is punishable by fines and imprisonment. - Can responsibility be avoided if the crime was committed negligently?

Economic crimes are usually punishable only when committed intentionally, though liability may arise from negligence if damage is caused. - What is the difference between administrative and criminal liability?

Administrative liability involves fines and certain restrictions, while criminal liability may include imprisonment. - What is the role of a lawyer in defending such cases?

A lawyer assists in gathering evidence, advising on legal issues, and representing the client in court. - Can companies be fined millions of euros?

Yes, legal entities can be fined up to 40 million euros for serious economic crimes. - What preventive measures can be taken against economic crimes?

Strict internal controls, regular audits, and legal consultations are recommended. - Can only the company’s CEO be held accountable?

Both the CEO and employees involved in unlawful acts can be held accountable.

Practical Examples

Example 1: A client faced a tax investigation that resulted in a finding of innocence, turning a potential criminal case into an administrative fine. Comment: Lawyer Ilya Zuyev helped reduce penalties by analyzing accounting data and effectively defending the client.

Example 2: A company was accused of money laundering, but the lawyer proved that the transactions were due to an employee’s error, with no criminal intent. Comment: The company avoided criminal liability and only received a fine.

Example 3: A private client was accused of financial fraud, but the lawyer demonstrated the client’s good faith and lack of malicious intent. Comment: The client was acquitted, and the criminal case was dismissed.

If you have questions or need legal assistance, contact sworn advocate Ilya Zuev.